Truss vs. Sunak: The place UK Management contenders stand on financial system | World News

Truss vs. Sunak: The place UK Management contenders stand on financial system | World News

[ad_1]

Truss vs. Sunak: The place UK Management contenders stand on financial system | World News

[ad_1]

Britain’s hovering inflation charge, slowing progress and a brutal cost-of-living squeeze will kind the backdrop of the competition to switch Boris Johnson as prime minister.

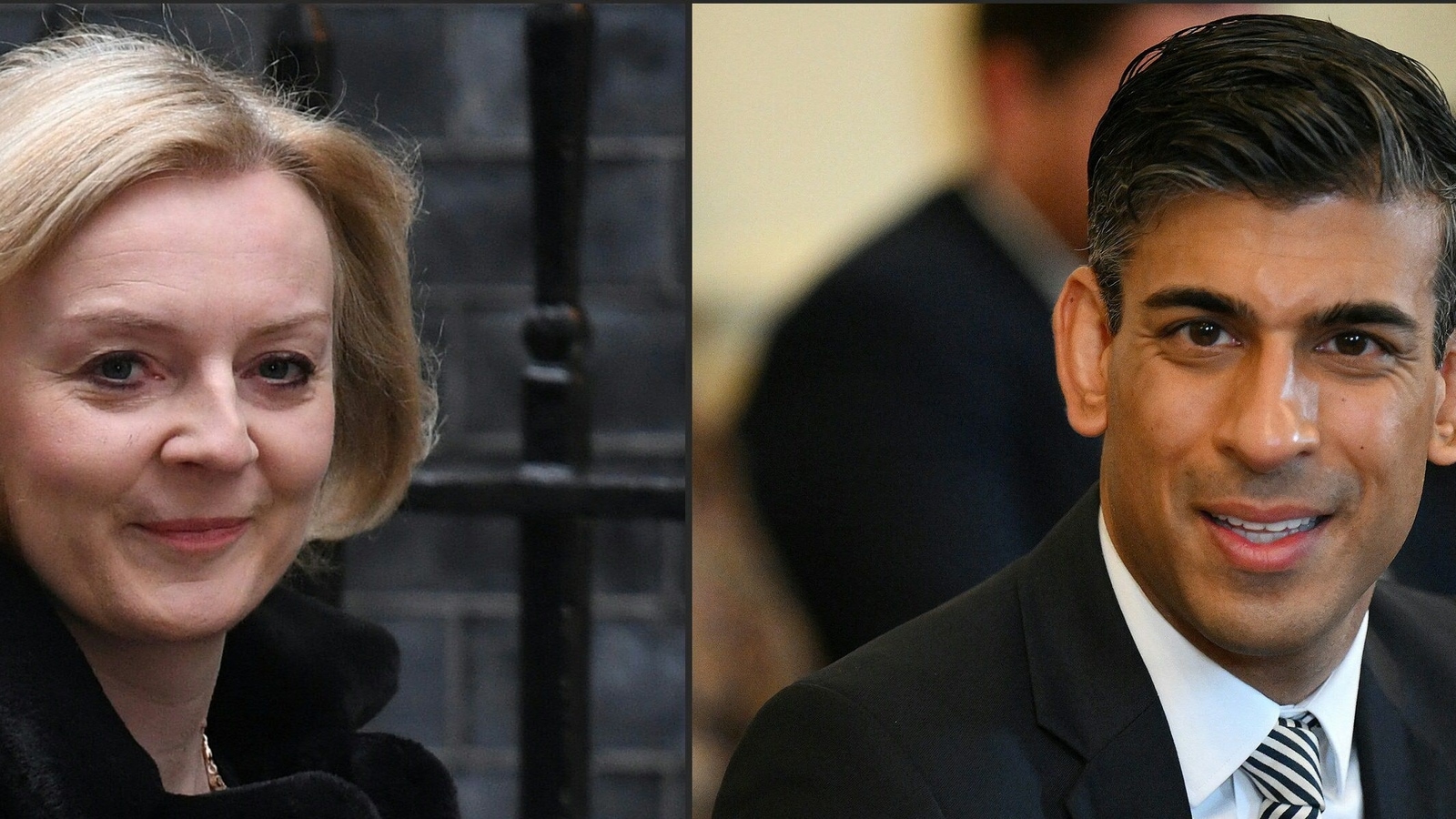

Liz Truss and Rishi Sunak, the ultimate contenders within the race to guide the ruling Conservative Get together and the nation, have sharply divergent views on easy methods to deal with the financial system and public funds.

Sunak, the previous chancellor of the exchequer, is the continuity candidate, standing for prudence with the general public funds. He fears that tax cuts will hold inflation excessive and make the price of residing disaster worse. He voted to go away the European Union.

Truss, the international secretary, is the tax-cutting financial radical who desires to supercharge progress, is anxious a few recession and would evaluation the Financial institution of England’s mandate. She voted to stay within the EU.

Inflation, the cost-of-living disaster, tax cuts, financial reform and public sector pay are more likely to function prominently within the debate.

Conservative members have till Sept. 2 to vote for a candidate, with a choice due on Sept. 5. Right here’s a breakdown of the financial platforms of the 2 candidates:

Rishi Sunak

As chancellor till his resignation earlier this month, Sunak’s financial platform is well-known.

He raised payroll taxes for workers and employers, and dragged extra employees into increased earnings tax bands by freezing thresholds. For enterprise, he tabled plans to elevate company tax from 19% to 25% subsequent 12 months.

He's sticking with the plans, which can enhance the tax burden to its highest stage in 70 years, and has tried to make a advantage of them.

He attacked rivals for telling “comforting fairy tales” about tax cuts, saying borrowing extra now would result in “increased inflation, increased mortgage charges, eroded financial savings.” And he promised “accountable” tax cuts “that drive progress” as soon as inflation is beneath management.

Drawing parallels with Margaret Thatcher, he identified that she additionally raised taxes within the face of excessive inflation and a looming recession in 1981.

Like her, Sunak insists that tackling inflation should be his precedence. He has backed the Financial institution of England, saying he was “anxious by a number of the issues I’m listening to” from different candidates, who've criticized the establishment.

Regardless of his fiscal prudence -- he insisted on a £12 billion enhance in payroll taxes to fund well being spending -- he claims to be an instinctive Tory tax cutter.

It could show a tough promote, although. Sunak is extra involved concerning the affect of rising rates of interest and inflation on servicing the nationwide debt than Truss, who voted in opposition to his payroll tax and is completely satisfied to borrow extra.

As chancellor, Sunak offered £37 billion of help for households throughout the price of residing disaster and has mentioned he would go additional if wanted.

His long term plan for progress hinges on “capital, individuals, concepts.” He desires to chop taxes on enterprise funding and in March 2021, unveiled the largest funding tax break in historical past.

It was accompanied by a rise in company tax for bigger companies to 25% from 19%, nevertheless, as he tried to sharpen the incentives for companies to take a position.

Monetary rules could be relaxed to offer long-term capital for enterprise, and the Apprenticeship Levy overhauled to extend spending on workforce coaching.

Citing his days in Silicon Valley, Sunak desires to make the UK financial system “probably the most revolutionary on the planet.” To take action, he'll reform analysis and improvement reliefs and unleash an funding “Huge Bang” by slicing again 2,400 EU legal guidelines to benefit from “Brexit freedoms.”

On pay for public-sector employees, Sunak believes the newest settlements are honest and wouldn't present additional funding, leaving departments to seek out financial savings to pay for the upper wages.

Liz Truss

In distinction to Sunak, the international secretary is an financial radical. She guarantees aggressive tax cuts to spice up progress on day one, vows to “tackle Whitehall” and even reform the Financial institution of England.

“The business-as-usual financial technique will not be daring sufficient for the disaster we’re in,” Truss mentioned. “We’ve seen gradual progress for many years. We have to do completely different.”

She pledged to “unleash a daring plan to reform our financial system” and accused Sunak of “choking off progress” by elevating taxes and main the UK into recession.

Truss has mentioned that on her first day as prime minister she would reverse Sunak’s enhance in payroll tax, scrap plans to lift company tax and briefly abolish inexperienced levies on power payments.

The insurance policies, a mix of rapid assist for struggling households and a long-term agenda for progress, would price greater than £30 billion and, in line with Truss, “might be paid for throughout the present fiscal envelope.”

In different phrases, the cash could be borrowed. Truss has argued that she would fund it by altering the therapy of £311 billion of debt taken on throughout the pandemic. Particulars of the mechanism have but to be offered.

Her spokesman mentioned it might be “handled as an distinctive merchandise to be paid off in the long run” and in contrast it to World Struggle II debt.

Britain’s warfare debt was at low rates of interest and paid over 50 years, with the primary installment made 5 years after the debt was taken. Annual funds have been deferred six occasions.

Truss’s broader progress imaginative and prescient is historically Thatcherite, marked by low taxes and deregulation. She has vowed to “simplify” taxes and guarantee persons are not penalized for caring for youngsters or relations.

She has additionally warned that elevating public sector pay might result in a wage value spiral.

She instructed The Occasions newspaper this week that she wouldn't deliver again austerity. David Cameron’s authorities from 2010 to 2015 made “cuts to public spending that weren’t sustainable. I cannot permit that to occur,” she mentioned.

Her insurance policies indicate huge will increase in debt, which she hopes could be made reasonably priced by a lot the sooner progress she believes she will be able to unleash.

Institutionally, she has additionally expressed a level radicalism. She questioned the BOE’s dealing with of inflation, vowing to evaluation its mandate. She made a cryptic reference to the Financial institution of Japan.

In accordance with her spokesman, Truss believes that a mandate evaluation is “overdue,” given the final one was 25 years in the past. He mentioned a nominal GDP goal might be thought of. The Japanese authorities launched a nominal GDP goal in 2015.

[ad_2]

0 comments: