Fitch downgrades Pemex attributable to a number of accidents – Muricas News

Fitch downgrades Pemex attributable to a number of accidents – Muricas News

[ad_1]

Fitch downgrades Pemex attributable to a number of accidents – Muricas News

[ad_1]

Fitch Scores lower the credit standing of Petróleos Mexicanos (Pemex) to B+ from BB-, along with putting the observe on adverse remark, as a result of weak working efficiency of the state firm and its monetary administration.

The lower within the observe of the Mexican oil firm – which happens per week after the hearth on the Nohoch-A processing heart, which belongs to the Cantarell marine manufacturing asset – locations it at a excessive threat stage, since it's two steps from diploma rubbish

.

The ranking company defined that the variation is because of the truth that Pemex is in monetary difficulties, but in addition as a result of historical past of environmental, social and company governance elements.

The sale displays the environmental and social impression related to a number of accidents at Pemex’s working services since February 2023, which resulted in casualties and accidents to its staff and injury to important infrastructure and property

.

Fitch recalled that because of conflagrations in essential property of the state firm, employees have died and others have been injured, a scenario that worries the operation or the shortage of assets for upkeep.

Excessive debt service and the necessity for the federal government to finance adverse money flows have been key causes for underinvestment

he careworn.

Intercam analysts thought of that the hearth on the Nohoch-A platform would have been The drop that spilled the glass

for Fitch to make the choice.

The conflagration left two employees useless and yet one more lacking, in addition to a drop of 100,000 barrels per day in July manufacturing, which can translate into a discount in income of round 132 million dollars.

Intercam careworn that the method of fines for Pemex by the Nationwide Hydrocarbons Fee is stopped, even supposing there are paperwork that reveal that varied sanctions have been omitted, specifically for non-compliance with the restrictions on the utmost quantity of gasoline burned allowed and the drilling of wells in Ixachi, in Veracruz, and Quesqui and Tupilco, in Tabasco.

The adverse outlook ranking, he mentioned, displays concern concerning the Mexican authorities’s means and willingness to enhance the corporate’s liquidity and capital construction over the following two years with out concessions from collectors.

Fitch estimates that Pemex will additional restrict its sources of financing from banks, traders and suppliers.

He recalled that the oil firm faces maturities of worldwide debt bonds for 4.6 billion dollars in 2023 and 10.9 billion dollars in 2024.

The lack to refinance debt from the capital markets with comparable long-term monetary devices would exacerbate its liquidity threat on the finish of 2024

he added.

Fitch estimated that Pemex will probably be a rising accountability for the federal government

as a result of in contrast to earlier years, the place the official participation exceeded Pemex’s money help wants, it should spend roughly 20 billion dollars greater than what it receives from the oil firm in 2026 and 2027, to maintain the corporate afloat. firm.

He added that if the state firm continues changing its monetary maturities into short-term debt, it should finish 2024 with nearly 35 % of its debt in that scenario.

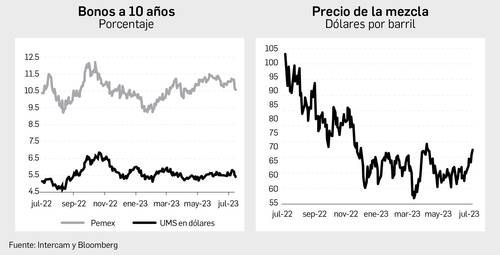

Final March, Octavio Romero Oropeza, CEO of Pemex, mentioned in an interview with The Convention (https://shorturl.at/cgPT2) that as a result of credit score notes granted by the ranking businesses, the speed that the markets cost Pemex is twice the speed paid for sovereign debt

which, he thought of, has no justification

.

Intercam’s evaluation highlighted that the deterioration of Pemex’s credit standing didn't have an effect on the worth of its bonds, for the reason that prospect of upper ranges within the value of crude oil greater than offset the adversarial impact of a potential demand for a better threat premium.

[ad_2]

0 comments: